Overview

Heard serves as the financial back office for therapists, managing their bookkeeping, taxes, and financial insights. For mental health therapists—trained as clinicians, not business owners—tax season represents a particularly stressful period as they balance patient care with business obligations.

Since launching tax services in 2021, Heard barely weathered two challenging tax seasons. While we retained customers, they reported feeling anxious, disconnected, and overwhelmed throughout the process. Our internal teams were equally strained, burning out from manual tasks and constant coordination between customers and tax preparers.

With the 2023 tax season approaching, our Executive Leadership Team prioritized both customer success and employee wellbeing. They assembled a dedicated cross-functional team to reimagine the tax experience. As this team formed, I led comprehensive discovery research to identify previous successes, failures, and critical needs for both customers and Heard employees heading into the new tax season.

Process

Discovery Research Parameters

To build a comprehensive understanding of our tax preparation service, we conducted a five-part discovery process:

We began by auditing two years of tax preparation history across both Sole Proprietor and S-corporation customers, analyzing retrospectives, internal notes, and support tickets. We then conducted targeted interviews with both churned and current customers from the 2022 tax season, followed by in-depth discussions with stakeholders and tax preparation teams.

Using these insights, we mapped the complete customer journey and developed a detailed service blueprint documenting all interaction points between customers and Heard employees. Finally, we synthesized our findings into an actionable research report highlighting successful elements, improvement opportunities, and specific recommendations for a customer-centric experience.

Discovery Research Learnings

Our analysis revealed key insights across three critical dimensions: Validation, Education, and Transparency.

Validation

Therapists are clinicians first, business owners second.

They seek expert financial guidance while maintaining focus on client care. Rather than forcing them to become accounting and tax experts, we needed to align our tax experience with their professional context.

Our research showed they deeply value understanding the reasoning behind financial decisions and want clear connections between requested actions and outcomes.

Close the loop. Therapists want to see how the tasks we ask them to complete lead to outcomes. Key questions included the purpose of monthly statement uploads and the relevance of spouse documentation.

Education

Make things easy to understand. Customers want to understand what is needed for a successful tax filing.

Tax preparation must be approachable and clearly purposeful. We identified three key principles:

Make complex concepts accessible. Customers need a clear understanding of requirements for successful tax filing, stripped of technical jargon and accounting complexity.

Create clear connections. Each step in the tax process must visibly link to specific outcomes, reinforcing that we're partners in their financial success.

Use human language. By translating tax terminology into plain English, we reduce cognitive load and build confidence:

"File Tax Form 1120S" becomes "File Your Business Tax Form (1120S)"

"Complete your reconciliation" becomes "Review Your Expenses"

Transparency

Our research revealed critical needs around clarity and control in the tax filing process:

Tax preparation creates significant anxiety for practitioners. They need clear assurance that their individual practice needs are being prioritized and maximized throughout the process.

Given their academic background, customers expect structured progress tracking and clear task management. We aligned our process with their natural work patterns by:

Breaking down tasks to fit within their standard 50-minute session blocks

Providing clear time estimates for each task

Creating visible progress indicators

We identified two key gaps in the current experience:

Customers needed better tools to analyze their practice data for informed decision-making

The lack of clear next steps created uncertainty about filing requirements and deadlines

Tax Team Delivery

Following the discovery phase, I transitioned to an advisory role, conducting deep-dive sessions with key stakeholders—our Staff Product Designer, Product Manager, Engineering Lead, and Senior Manager of Tax. These sessions ensured thorough understanding of research insights and guided implementation.

The team developed four distinct tax experiences designed to streamline information collection while reducing customer anxiety. Each feature focused on guiding customers through the tax preparation process while efficiently gathering essential business and personal tax documentation.

Every workflow was built around two core principles: clear customer communication and efficient internal document collection. Each experience addressed critical questions:

Expected time commitment for completion

Clear outline of deliverables

Specific customer requirements

Transparent next steps

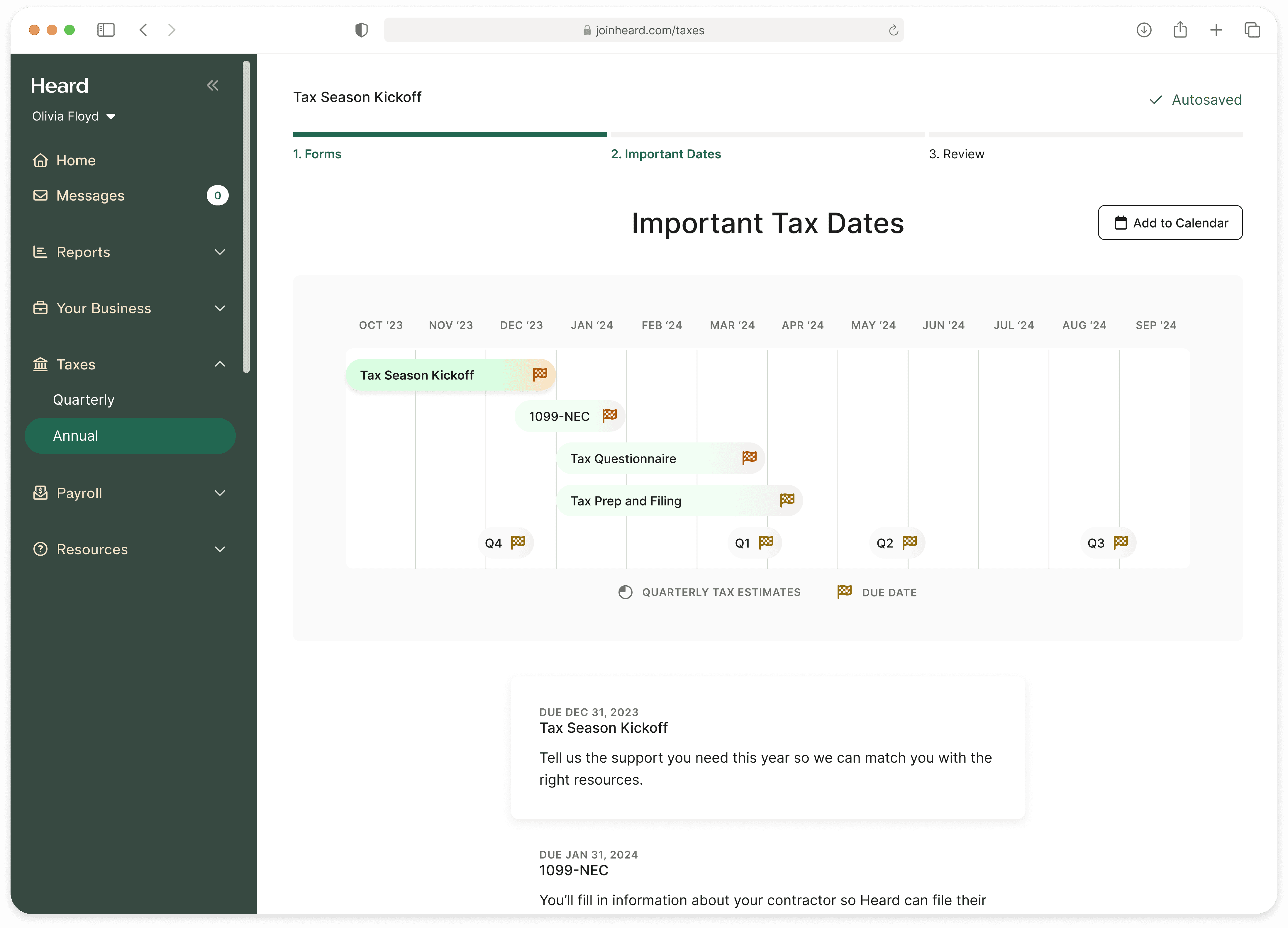

Tax Season Kick-off (TSK)

This streamlined workflow guided customers through tax filing confirmation, life event updates, and a comprehensive 2023 tax season overview. The results demonstrated clear success:

98% customer opt-in rate for tax preparation services

96% completion rate for all required tax forms

Average task completion time under 90 seconds

Year-End Review (YER):

This workflow empowered customers to finalize their books while resolving any outstanding income or expense transactions that required clarification. By creating a dedicated space for financial reconciliation, we ensured accurate tax preparation inputs.

1099-NEC

This workflow guided customers through 1099 filing requirements for contractors who received payments exceeding $600 in 2023. By streamlining this critical compliance task, we helped customers fulfill their reporting obligations efficiently.

Tax Checklist (TC)

This intuitive, TurboTax-inspired workflow streamlined the tax preparation process by guiding customers through deduction identification, tax form submission, and supporting documentation collection. The familiar interview-style format transformed complex tax requirements into manageable steps.

Outcome

The reimagined tax experience delivered unprecedented results. Heard successfully processed 5x the tax return volume compared to 2022, while significantly reducing completion times. Most notably, 78% of customers who used the new tax experience indicated they were "very likely" to file with Heard again in 2024—dramatically exceeding the industry average satisfaction rate of 15%.

Our discovery research proved crucial, shaping every customer touchpoint throughout the annual tax process. The transformation achieved dual objectives: delivering an exceptional customer experience while protecting our internal teams from manual overload and burnout. This enabled us to double our customer base year over year without sacrificing quality or team wellbeing.